Credit Market Comment

1 March 2024

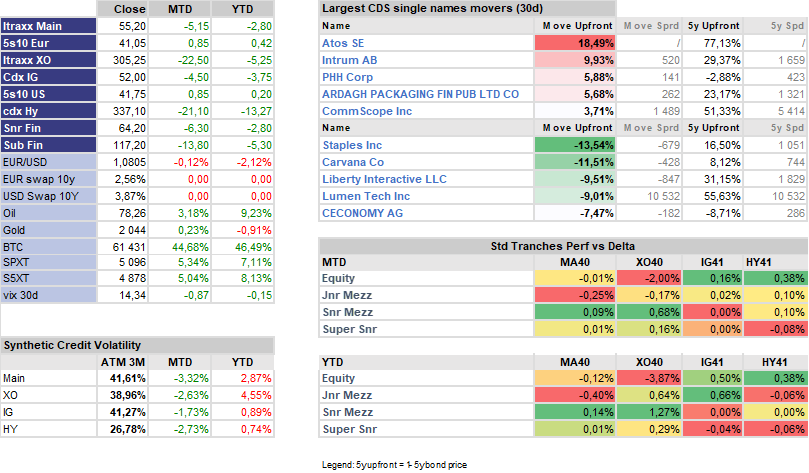

The credit market was firm in February with Itraxx Main tightening to 55bps (-5). This bull market is a good reflection on how primary did, with large volume steadily finding a home.

Credit volatility got offered a couple of percentage points but remains above year end levels. Longer dated convexity was pretty much unchanged with 5s10s curve following its beta (0.3) to the 5y index and steepening by almost 1bp to 41bps, so there is probably some room left for further performance into the roll.

Default correlation caught an offer, especially in Europe and in the HY space that saw a stronger performance of the senior mezzanine and super senior tranches. The synthetic high yield strongly outperformed the cash, that went the other way due to investor flows and this even tough dealers’ inventories have been rising.

USD Rates got lifted by 30bps to 390bps (10y swap) since the beginning of the month and the larger than expected change in non-farm payroll (353k vs 185k). It strongly benefited the fund that outperform HY cash by about 1% mainly due to duration risk being very short.

Key figures