Analyzing Synthetic Credit Instruments as Alternatives to Cash Bonds (disponible uniquement en anglais)

9 July 2024

We recently emphasized on Linkedin about the features of Synth Credit vs Cash bonds, please click here to find our illustrative data about this topic.

--> Get in touch with our Credit Team to discuss further

In case you missed it, please retrieve our paper below :

The Case for Synthetic Credit: Analyzing Synthetic Instruments as Alternatives to Cash Bonds

In asset management, particularly within alternative investments, synthetic credit instruments present an alternative to traditional cash bonds. This analysis outlines the differences between cash and synthetic credit instruments and explores the advantages of considering synthetic credit in investment portfolios.

Defining Cash and Synthetic Credit Instruments

Cash Bonds and Credit Instruments: These are traditional debt instruments, including bonds, loans, and cash CDOs (Collateralized Debt Obligations), which encompass CLOs (Collateralized Loan Obligations) and CBOs (Collateralized Bond Obligations). Investors in these instruments own the underlying physical assets.

Synthetic Credit Instruments: Synthetic credit includes derivative instruments like Credit Default Swaps (CDS) and synthetic CDOs (CSOs). These instruments provide exposure to credit risk without requiring ownership of the underlying bonds or loans. Although synthetic credit is less commonly utilized due to high barriers to entry, it has distinct characteristics worth noting.

Advantages of Synthetic Credit

Pure Credit Exposure: Synthetic credit offers more direct exposure to credit risk compared to cash bonds, which can be affected by other factors such as interest rate risk and liquidity risk.

Unfunded Nature: Cash instruments necessitate full funding, meaning investors must provide the entire notional amount upfront. Synthetic instruments, however, are typically unfunded, requiring only initial margin, floating leg, and periodic premium payments, which lowers the initial capital outlay.

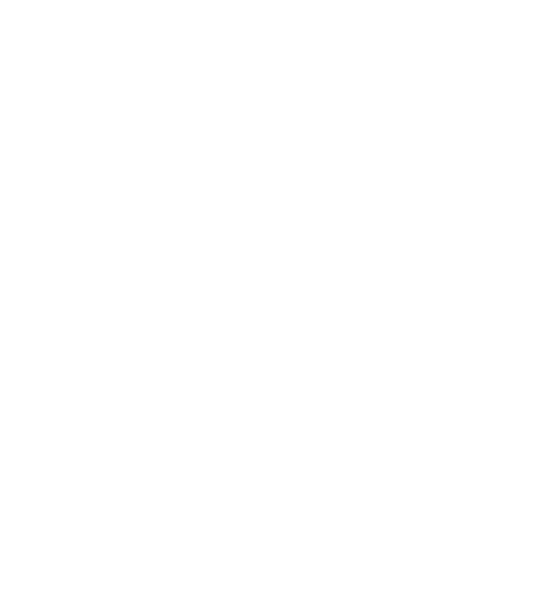

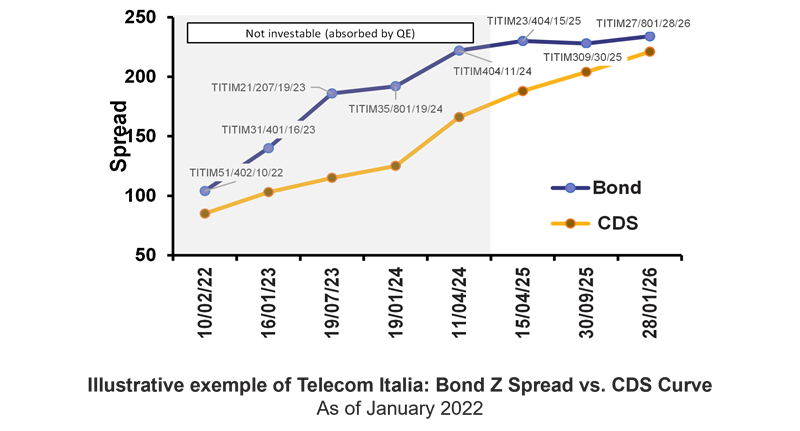

Flexibility and Positive Basis: Cash instruments are primarily used to acquire risk in a long-only market, with short selling being expensive. Synthetic instruments, in contrast, can be used for both buying and selling. Recently, the synthetic spread has been comparable to or larger than the cash spread.

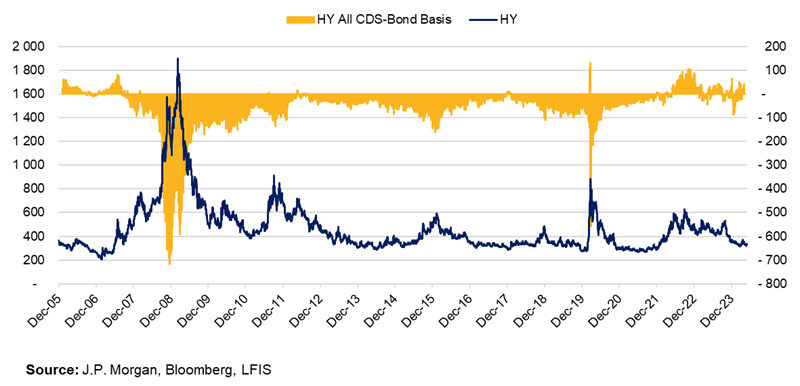

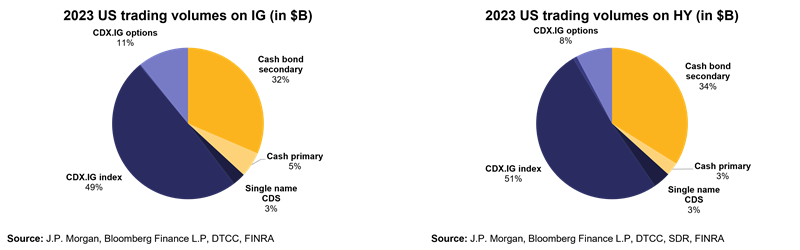

High Market Liquidity: Synthetic instruments benefit from a two-way market, enhancing liquidity, especially during periods of market stress. Conversely, cash instruments often face liquidity challenges in bear market conditions.

Enhanced Return Potential: The yields from the excess carry and roll-down of synthetic credit instruments tend to be higher than those from cash credit instruments. This is due to the bias within the investor base, which can lead to superior performance in various market contexts.

In conclusion, synthetic credit instruments are a viable alternative to traditional cash bonds. They offer pure credit exposure, require lower initial capital, provide market flexibility, maintain high liquidity, and have the potential for enhanced returns. These features make synthetic credit instruments a relevant consideration for asset managers and investors aiming to optimize their portfolios.