Credit Market Comment

2 January 2024

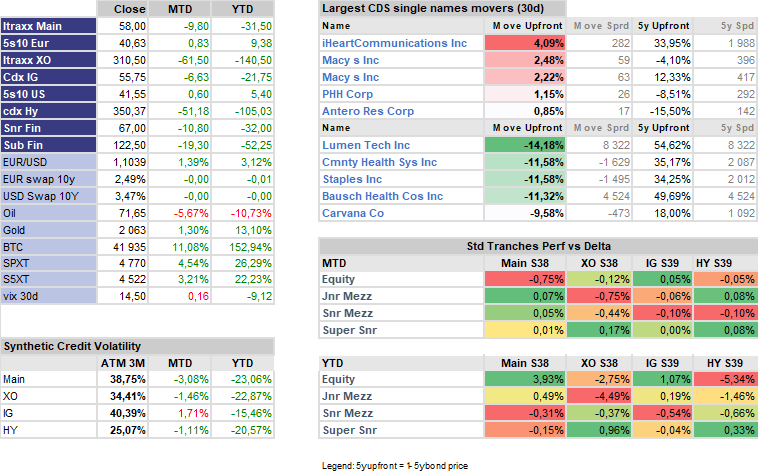

- Rates triggered the solid performance of stocks and credit during the month of November. It kept going in December by another 50bps on 10y EUR swap. Synthetic credit supported the move but not as much as absolute level seem fairly tight already.

- Flows were mainly driven by real money hedging out bear credit option strategies expiring in January or February. Specifically, on Xover and HY indices which led to a decent compression move both in Europe and in the US.

- Interesting fact: with rates rallying 50bps we should have expected an outperformance of the cash indices… But the synthetic vs cash basis acted as a buffer with not much flow on cash products and synthetic outperforming massively vs. cash product excess return.

- 2023 proved to be one of the best year for Credit, either cash or synthetic, with low volatility overall. Value transfer in the capital structure created many dislocations and investing opportunities benefiting alpha capture in the synthetic credit space.

- With a cleared picture of Central banks actions for 2024, investors’ concerns switched to geopolitical risk again for the beginning of 2024. This is always very discretionary to hedge it. Another milestone would also be yearend corporate results that will reveal their abilities to absorb the decrease of inflation.

Key figures