Capturing the current opportunity set for credit

14/09/17

No time to be complacently long but too soon to be outright bearish. The opportunities in-between.

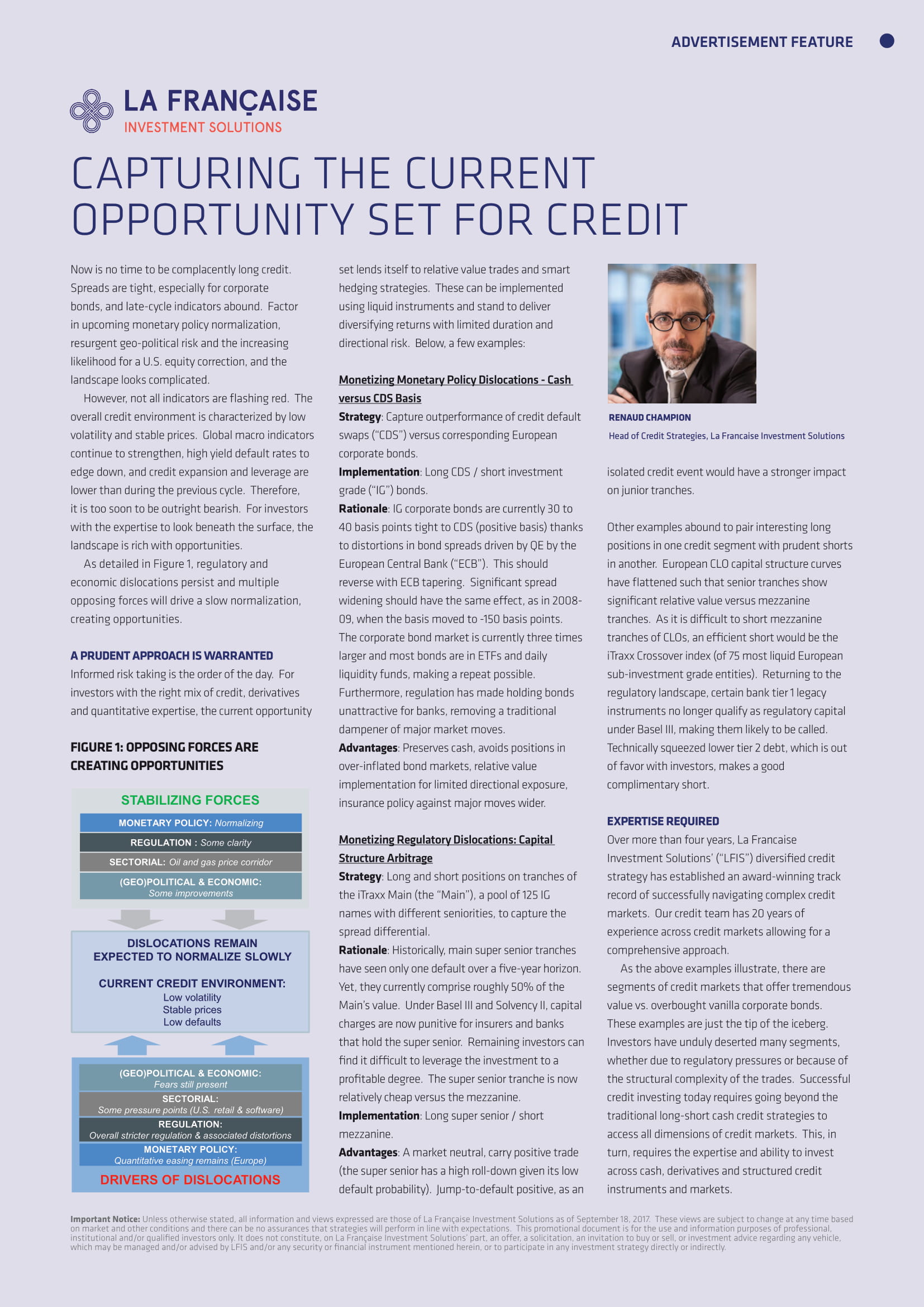

Now is no time to be complacently long credit. Spreads are tight, especially for corporate bonds, and late-cycle indicators abound. Factor in upcoming monetary policy normalization, resurgent geo-political risk and the increasing likelihood for a U.S. equity correction, and the landscape looks complicated.

However, not all indicators are flashing red. The overall credit environment is characterized by low volatility and stable prices. Global macro indicators continue to strengthen, high yield default rates to edge down, and credit expansion and leverage are lower than during the previous cycle. Therefore, it is too soon to be outright bearish. For investors with the expertise to look beneath the surface, the landscape is rich with opportunities.