Download

A triptych approach for reverse stress testing of complex portfolios

31/03/2020

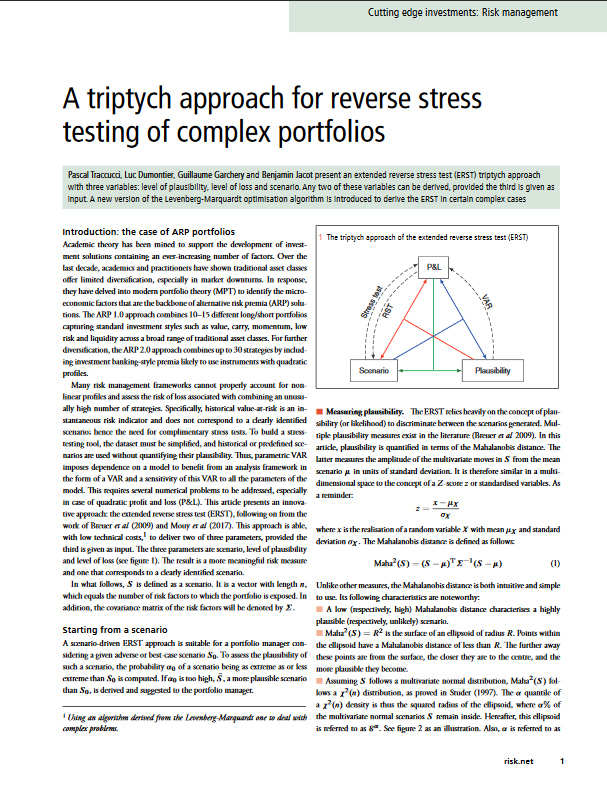

An extended reverse stress test (ERST) triptych approach for portfolio and risk management of complex portfolios.

LFIS in collaboration with La Francaise Group, present an innovative extended reverse stress test (ERST) triptych approach.

The ERST approach relies on three variables: level of plausibility, level of loss and scenario. Once any one of these inputs is known, the other two can be derived. This novel approach is particularly relevant in a context where investment solutions are increasingly complex, with an ever higher number of strategies (bringing an increased risk of re-correlation) and extensive use of derivatives instruments (with non-linear profiles).