Credit Market Comment (disponible uniquement en anglais)

3 June 2024

Looking back on the Credit market in May, rates closed the month unchanged on the 5y, despite realizing about 20bps moves during the period. During the first week of May, FED Chairman Powell's commentary on job reports was less hawkish than anticipated. Subsequently, concerns arose regarding the potential for consumer price index (CPI) growth to exceed expectations. However, the CPI ultimately rose by 0.3% compared to a 0.4% forecast, prompting a 10bps tightening in rates and a subsequent rebound to around the announcement. As a result, the yield was pricing in a first rate cut in July again.

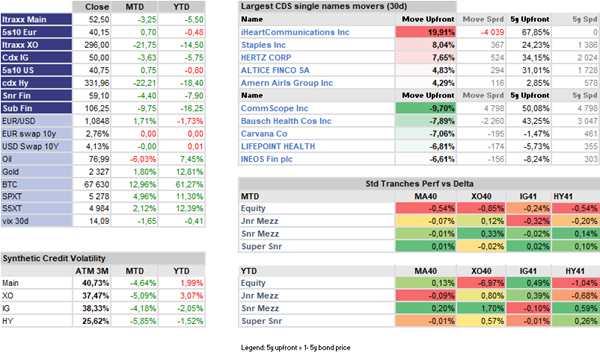

Regarding market flows, the combination of rate activity and the bank holiday weekend led to a steady tightening of credit spreads (Itraxx Main 52.5 -3.25bp) and high-yield to investment-grade compression (296 -22bp). Carry was the main driver for this bullish move, even if it was further influenced by negative gamma flows.

Credit curves didn’t move much and realized their carry.

Focusing on the tranche market, the spread dispersion was minimal. And most of idiosyncratic moves were muted by dealers’ trade ideas. That essentially pushed for a High Yield Europe correlation rise via tight spreads’ issuer widening.

In this context, LFIS Credit strategy's performance is currently up 3.55% year-to-date (1.13% over the past month) compared to iHYG, which has only gained 0.75%. The outperformance of May was driven by a lower correlation and the cash vs. CDS basis that compensated more than the negative HY vs. IG compression factor.

Key Figures