Credit Market Comment (disponible uniquement en anglais)

2 April 2024

In March, Firm is the word !

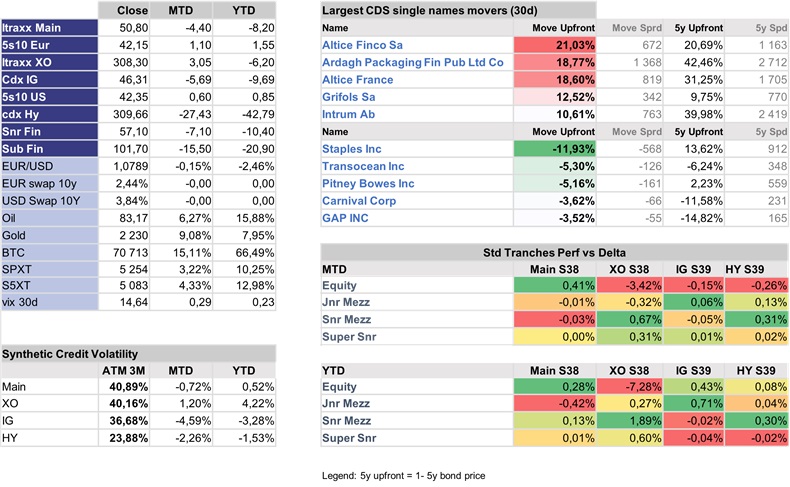

Despite the rise of realized volatility on the front end, medium to long end convexity didn’t pay out and curve remained fairly steep in march. Obviously the technical of the index roll supported that slide a lot, and the synthetic credit market remained strong..Itraxx Main tightened 4.4bps along with the US (still slightly outperforming Europe). But Itraxx Xover closed +3bps to materialise decompression. Most of this came from idiosyncratic stories, and bearish ones obviously, Grifols, Intrum, Altice, Ardagh … So default correlation in itraxx Xover dropped by a fair amount and dispersion trade kept paying. While the correlation rose for Itraxx Europe in the tightening, sustaining a good rationale for entering a synthetic Credit Strategy !

This HY vs IG decompression was the performance driver of the fund in March. It realised +1.17% vs cash, while the basis compensate duration.

On the first quarter of 2024, that is a total +2.3% outperformance of our Synthetic Credit fund vs. the HY EUR cash benchmark. (basis -0.4% | decompression 1% | correlation 0.3% | duration 1.4%).

Key Figures