Credit Market Comment (disponible uniquement en anglais)

1 February 2024

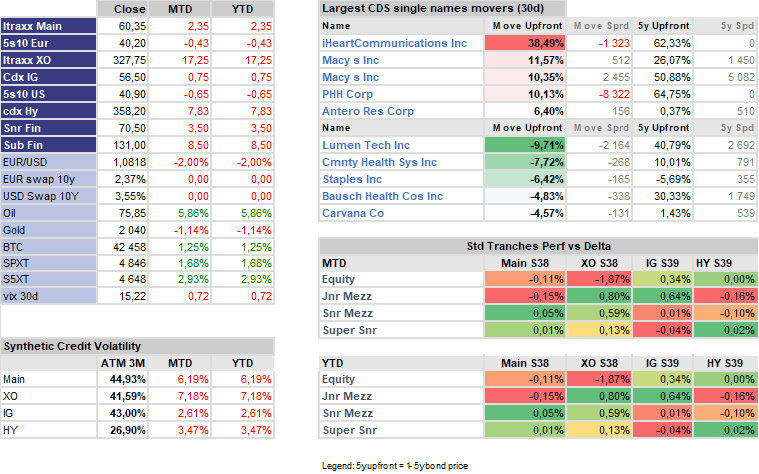

- European Investment grade spreads widened by 2.5bps to 60.5 since the beginning of the year, triggered by a strong rise of volatility (47% +10% ATM) during the first week. It felt like froth being taken out of the market post the drop in liquidity at year-end. Not necessarily a massive change of view from a macro standpoint (Central banks cuts are still being priced for Q2) but decent primary volumes and some derisking.

- Curves essentially range traded slowly, still offering a decent carry roll down from here. But the beta to outright long still being at the bottom of the range (about 30%) it is fair to hedge out the potential of negative convexity..

- Decompression materialized somehow but essentially thanks to ATOS selling off about 40%, no systemic downside convexity at play here, but still another example of the protection offered by Ucits Credit vs its benchmark..

- Default correlation rose with spreads and triggered some outperformance of US IG equity and low mezzanine. The spread dispersion in the Xover basket neutralized the move for the equity tranche: almost 2% down vs its delta, while the mezzanine benefited from the correlation rise. Overall belly seems rich and second-order convexity is probably the best funding leg for at-the-money gamma.

Key Figures