Credit Market Comment (disponible uniquement en anglais)

2 May 2024

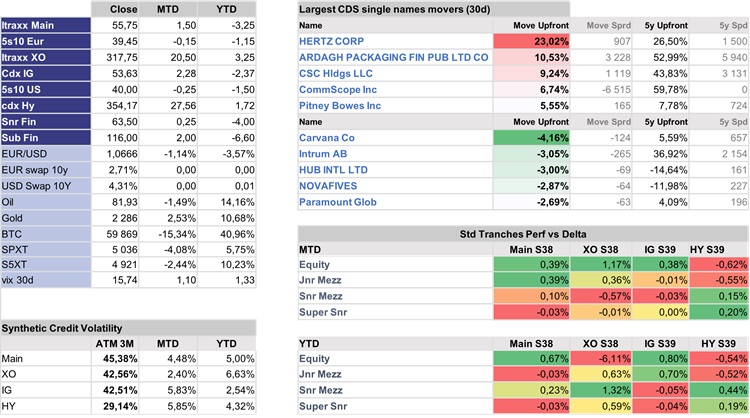

With Geopolitical headlines heating up the markets, we saw volatility rising and credit was not immune to it.

Itraxx Main ranged 54-64bps finishing the month only 55.75 +1.75bps and 1mth at the money credit volatility 40.6% +3.9%. It rose to 58% with invested 1mth-3mth calendar for barely 4days in a row. The US IG, US HY, financials, and curves traded along their beta to main, without going sideways.In the meantime, dispersion dropped a little with the European HY index with good news from distressed credit and a global decompression materializing for low beta credits. This decompression had multiple drivers outside fundamental analytics. Emerging Market managers picked it as their bond portfolio hedge due to commodities/margin pressure potential, while CTA accounts went out of Xover for trend following 2 weeks into the month. Finally, Hedge Funds built on the trade.

The rates move was also significant and mainly due to a hot CPI print on the 10th that led the market into pricing less than two 25b6 rate cuts by year end.

Still, the move was contained enough, and HY Real Money managers having cash pockets deep enough so it got absorbed by the synthetic vs cash basis.In this context, LFIS UCITS Credit fund, with -0.14% month-to-date, performed slightly better than iHYG at -0.17%. Year-to-date it remains +2.32% above it : +2.39%, the protection against HY default or rate risks looks worth it from here again.

Key Figures